Fresh look, same great service. New website coming soon!

- Personal

- Business

-

Call Us

- Customer Service: (800) 210-8849

- Refinance: (877) 319-0577

Cash-Out Refinance: Using Home Equity to Pay Off Debt

Americans are in more credit card debt than ever, and there is a simple, proven solution: cash-out refinance. Whether it’s credit cards, car loans, or student loans, if you’re a homeowner looking for cash and have equity in your home, a cash-out may provide you with a simple and achievable way to get out of debt.

If you used your credit cards in the past year to help with daily living expenses because of increased inflation and the cost of living, you are now paying higher interest for those credit card purchases. Why would you continue to pay 20% interest1 for gas you bought last year instead of consolidating your debt by refinancing your mortgage?

How Do Cash-Out Refinance Loans Work?

A cash-out refinance takes the equity you have built up in your home, replaces your current home loan with a new mortgage, and when you close on the loan, you get the difference back in cash. You can use this cash however you would like, including to pay down debt.

Crunch the numbers with our mortgage refinance calculator.

Benefits of Consolidating Debt

A cash-out mortgage refinance can be a smart move to help consolidate or pay off your debt. Paying off multiple loans and high-interest debt can help you streamline your monthly payments and provide multiple benefits.

- Interest Saving: Mortgage interest rates are typically lower than interest rates on other types of debt, such as credit cards and personal loans, meaning you can save on interest.

- Reduced Monthly Payments: If you have a lot of high-interest debt, your monthly payments may be very high. You can potentially reduce your monthly payments and make it easier to start saving monthly.

- Simplified Budget: Managing multiple debts with different rates and due dates, can be stressful. By consolidating your debt into one loan, you can simplify your budget and stay on track.

- Improved Credit Score: When you pay off debt, your credit score can improve. This can make it easier to get approved for loans and other forms of credit in the future.

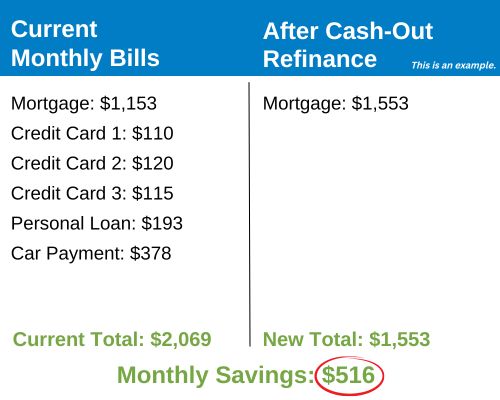

Here is a simple example of how you can use the cash you receive to pay off multiple debts, simplify payments, and lower your overall monthly bills.

Where Does Your Home Equity Come In?

The amount of money you can receive with a cash-out refinance varies and is dependent on the amount equity that has been built up in your home. Home equity is the difference between what is owed on the mortgage and what the home is currently worth. For example, if you owe $100,000 on your mortgage and your home is worth $350,000, this means you have $250,000 of home equity.

Two ways home equity can grow are:

-

the amount of equity in your home will rise as you pay down your mortgage and

-

the amount of equity will increase if the value of your home goes up

Explore additional advantages of a cash-out refinance.

Ready to review your cash-out options and how much debt you may be able to pay off? Our PHH Loan Officers can calculate your current equity and available cash.

Or call us at (800) 451-1895

Any equity cashed out in refinance will increase the mortgage balance owed on the property. Rates are not guaranteed and based on the applicant’s credit history at the time of application.

1 https://www.creditcards.com/news/rate-report/

THIS IS AN ADVERTISEMENT. YOU ARE NOT REQUIRED TO MAKE ANY PAYMENT OR TAKE ANY OTHER ACTION IN RESPONSE TO THIS OFFER.

Ready to Buy or Refinance?

Need Help? Call Us

Ready to Buy or Refinance?